Centrelink and Age Pension

Are you making the most of your Centrelink and Age Pension entitlements?

Our Age Pension Planning service ensures you receive the benefits you're eligible for without unnecessary reductions or hassles.

What is Centrelink and Age Pension Planning?

Navigating Centrelink and Australian Age Pension entitlements can be complex. Without the right guidance, retirees may receive less than they are eligible for, causing frustration and loss.

Omura offers expert Centrelink financial advice, helping both retirees and pre-retirees make more informed decisions that can maximise their Age Pension entitlements. By carefully structuring income and assets, we ensure individuals can access the highest possible financial benefits while complying with all Centrelink regulations.

Speak to our teamOur Financial

Modelling and Cashflow

Management Work

in Action

Cash Movements

Inflows

Outflows

Asset Base

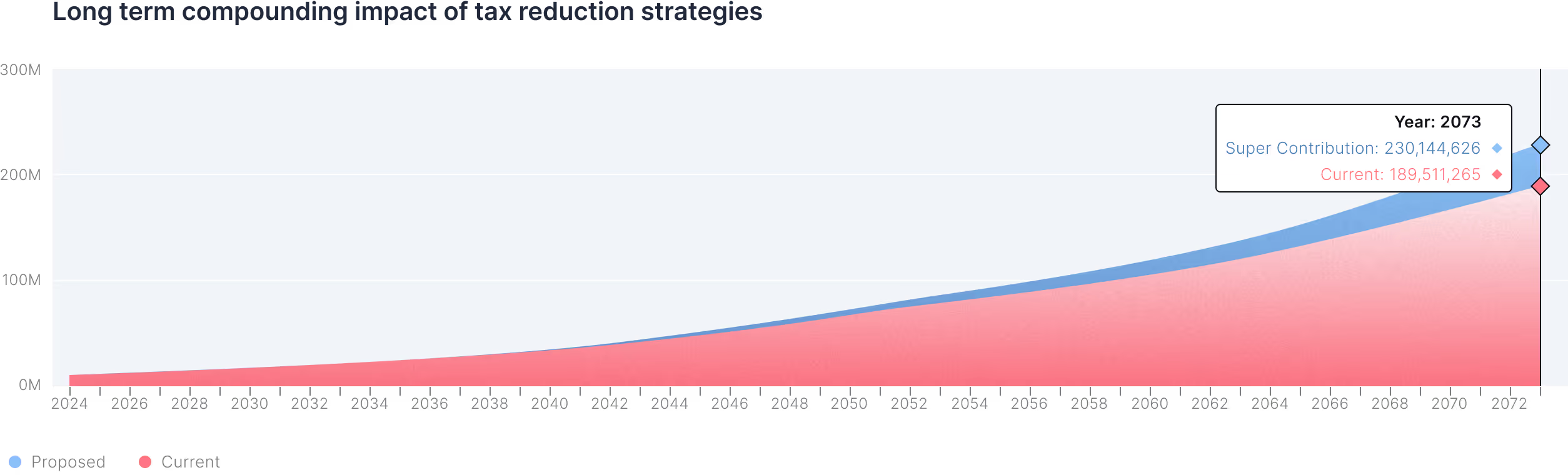

Our Taxation and Structuring Advisory Work in Action

Our Retirement Planning Work in Action

.avif)

.avif)

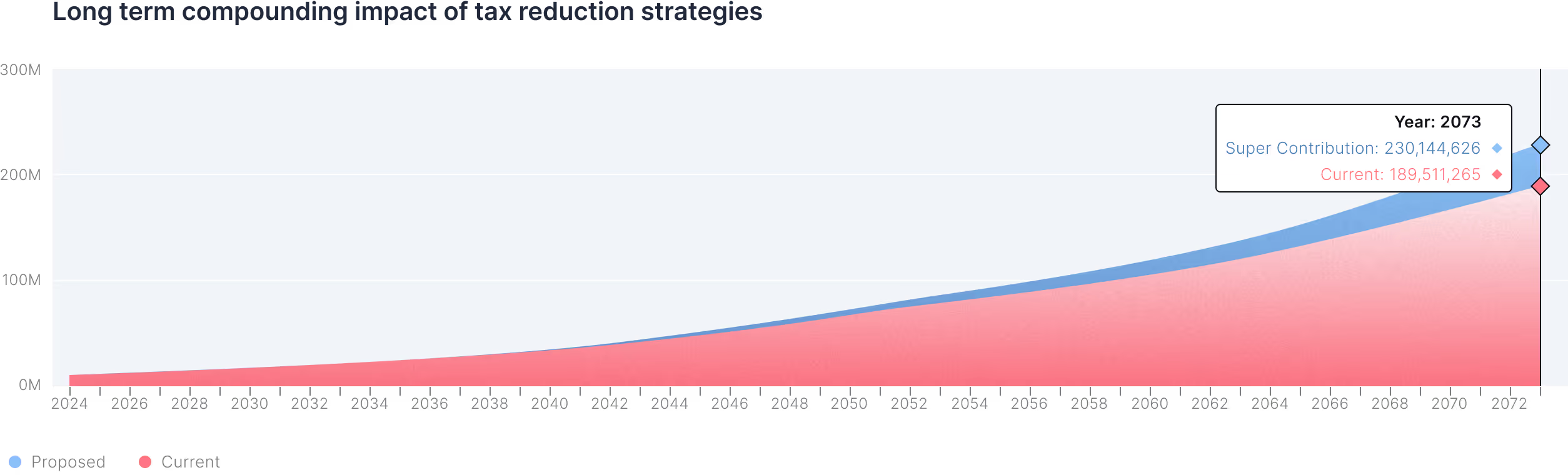

Our Superannuation Work in Action

.avif)

.avif)

Making the Most of Your Superannuation

Many Australians view superannuation as a passive savings account, expecting it to grow on its own over time. However, this is quite passive and can potentially slow down the growth of your super nest egg. The truth is, without the right financial guidance, there can be so many missed opportunities to use strategic approaches that can significantly grow your retirement wealth. Let’s chat.

Book an initial callOmura’s Superannuation Strategies for a Stronger Future

While our superannuation financial advisory services are bespoke and tailored to each person, our overall approach to superannuation advice includes:

Our Comprehensive Approach to Superannuation Advice

Selecting a super fund that aligns with your long-term financial goals

Implementing tax strategies to optimise your retirement savings

Adjusting risk exposure to match your life stage and retirement plans

Selecting a super fund that aligns with your long-term financial goals

Exploring investment options and superannuation structures, including wrap accounts, SMSFs, master trusts and industry funds for greater flexibility and growth

.png)

Making the Most of Your Insurance

Many Australians overlook insurance, becoming complacent.

However, it’s just as important a part of your financial plan as investment and portfolio planning. We don’t sell insurance. However, we help you determine the right level of coverage, structure it tax-effectively and ensure it adapts as your financial situation evolves.

Book an initial callOmura maximises Age Pension entitlements for long-term financial security.

Omura’s age pension planning aligns with your financial position to maximise Centrelink and Age Pension entitlements, ensuring long-term retirement stability.

Maximised Pension Strategies

Building strategies that optimise pension eligibility for maximum entitlements and not “just filling out forms.”

Centrelink Risk Reduction

Minimising pension reduction risks with expert Australian Centrelink financial guidance.

Structured Retirement Planning

Helping retirees secure long-lasting financial security with structured Centrelink and Age Pension planning.

My husband died at age 37. Here’s how I survived financially

For Lisa Chew and the families of the 20,000 people who die every year in Australia aged between 20 and 60, there are few consolations.

.svg)

We empower retirees to optimise their Centrelink and Age Pension benefits for a secure future and complete peace of mind.

Prepare your Age Pension. Protect your well-being.

Navigating Centrelink and Australian Age Pension entitlements can be complex. Without the right guidance, retirees may receive less than they are eligible for, causing frustration and loss.

Money, Well-being and

the Role of Financial Advice

the Role of Financial Advice

Health and Well-being Benefits from

Strong Financial Literacy

Strong Financial Literacy

What Clients Say About Omura’s Help Securing Entitlements

Omura offers expert guidance to help you navigate Centrelink and Age Pension rules, ensuring you receive the true benefits you’re entitled to.

.svg)

Terry provided me an entire scope on my financial goals and explained a few different indepth strategies. I have to say thanks terry for the advice and talking in a simple non technical language to understand. Highly recommend.

After researching 5 advisors, majority of them had a "robotic" systems where you had to book into their calendar and pay an exuberant fee for a 1 hour initial consult before you could speak with them to see if they had any past experience with your financial / life circumstances.

I chose to engage Terry to manage my finances due to the fact he took the time to understand my situation/circumstances and provide me with valuable guidance before we even spoke about fees. Terry managed to guide me through all of the tax elements in relation to TPD and work injuries and how to navigate through these "grey" areas, saving me a fair bit in tax by strategically mapping out the road moving forward. I would highly recommend having chat with Terry before you commit to and advisor as I found him to be the most professional and transparent.

I chose to engage Terry to manage my finances due to the fact he took the time to understand my situation/circumstances and provide me with valuable guidance before we even spoke about fees. Terry managed to guide me through all of the tax elements in relation to TPD and work injuries and how to navigate through these "grey" areas, saving me a fair bit in tax by strategically mapping out the road moving forward. I would highly recommend having chat with Terry before you commit to and advisor as I found him to be the most professional and transparent.

Andrew M

Make the most of your Age Pension with purposeful planning.

Omura provides expert financial advisory strategies for planning your wealth in a way that optimises your Age Pension and Centrelink eligibility

Our approach helps manage your assets and income to navigate the complexities of pension thresholds while preserving your wealth. We ensure that your financial plan is structured to support both your current and future financial needs.

Book an initial call

.svg)

.svg)